Market dynamics are evolving with a game changing shift in tourist profile from a historical ‘Eurocentric' dependence on long haul European visitors to short haul Asian travelers. Driving this trend is a weakening of the euro and pound which have jolted traditional market sentiment and transformed travel patterns to the resort island destination.

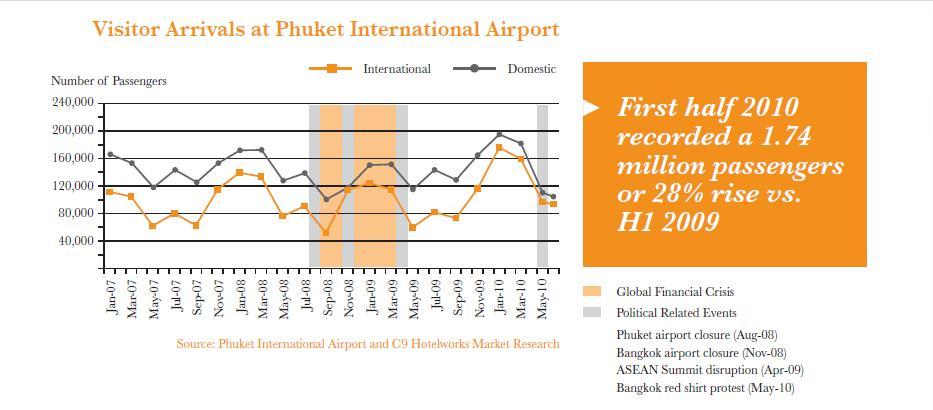

First half of 2010 signaled a rebound of Phuket tourism with a growth of passengers by 28% vs. H1 2009 and 11% compared to H1 2008. A boost in direct flights from Asia and Australia contributed to a surge in the number of flights by 30% and 11% compared to first half of 2009 and 2008 respectively.

The effect of political demonstrations in Bangkok hit passenger traffic through Phuket International Airport in Q2 2010 as evidenced by a 38% decrease from the previous quarter comparing to a 26% shortfall for the same period last year.

Thailand’s Airport Authority (AOT) expansion program of Phuket International Airport is underway with a start of construction activity by the end of this year announced. Scheduled to complete by 2013 the improvements will double annual airport capacity to 12.5 million passengers. AOT is soliciting bids for a jet terminal as part of its business development strategy. The proposed terminal is planned to be up and running in the next three years to serve demand from private charter jets and high net worth individuals.

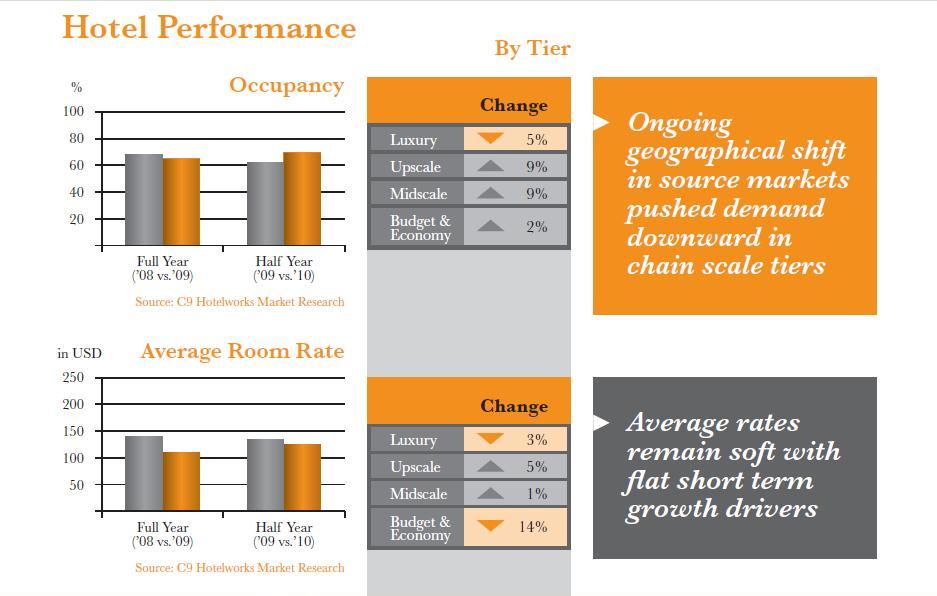

“Phuket hotels are back on track from the low point of last year. Passenger traffic through Phuket International Airport in H1 2010 surged 28% from a year ago, and 13% from the latter half of 2009 signaling a solid return in its tourism industry. A significant sign of recovery can be seen in the improvement of hotel wide performance. Hoteliers saw higher occupancies rise from 61% in H1 2009 to 70% in the same period this year. This came at a cost resulting in a decrease in room rates by 9%.

Upward trend in room demand will gradually drive average daily rates and RevPAR higher. As east coast hotels reach critical mass, questions remain on market acceptance and resulting penetration. Forecasted robust growth from Asia and Eastern European visitors will create challenges to hotels with new pricing sensitivity, shift in location preference and demand generators.

Currency devaluation of the euro and U.K. pound could prolong a move back to sustained growth. Increasing concern on supply and demand with new openings representing 33% of the development pipeline expected to enter the market supply within the second half 2010.

Sustained devaluation of U.K. pound has directly impacted shrinking British inbound market. Australian visitors have been the number one source market since 2005 with a compound annual growth rate (CAGR) of 31%. The global economic crisis in 2008 initiated a dramatic shift from the long haul European tourists to the short haul Asian and Middle East market, contributing to a transition in guest profile and needed adjustment of product offerings. U.S. and European currencies remain volatile and have contributed to a potential transformation in Phuket’s guest profile towards greater reliance on Asian countries with growth economies.

Source: C9 Hotelworks Market Research

C9 2010 Hotel Market Update: Mid-Year Edition August 2010

About C9 Hotelworks : C9 Hotelworks is an internationally recognized consulting firm with extensive experience in the Asia Pacific region.

Their core business focus includes: Hotel and Resort Development / Asset Management / Ownership Representation / Project Feasibility and Analysis

With key competencies including international hotel operator search, selection and contract negotiation, mixed use hotel and residential planning and operation reviews. A wide range of both institutional and private developers and a comprehensive portfolio of completed projects, give C9 the skill set and background to focus on key issues, evaluate complex ones and assist their clients in achieving solid results.

No comments:

Post a Comment